With RBI editor Douglas Blakey, Kevin Levitt, head of NVIDIA Financial Services, discusses the current state of Artificial Intelligence Market in financial services.

Eighty percent of the world's leading financial institutions are investing billions of dollars in artificial intelligence to enhance their offerings and compete with one another. NVIDIA's most recent research reveals what these businesses are doing and how they are using these resources.

Key takeaways from NVIDIA's State of AI in Financial Services 2022 Trends Report:

Detection of fraud: Eight out of ten financial institutions are utilizing AI to reduce the annual global fraud figure of $5 trillion;

Conversational AI is the use of Artificial Intelligence Market by banks in a variety of customer service channels, including self-service chatbots and virtual agents in call centers that work alongside human agents;

Personalized recommendations: AI-led recommendation systems are providing bank customers with extremely individualized experiences, ranging from robo advisers to the optimization of marketing and cross-sales channels.

Banks must now prioritize AI-enabled innovation in order to compete for customers' financial data with fintech, big tech, big box retail, and incumbent banks. This is made worse by industry-wide deployment of highly innovative digital experiences that continue to shift consumer expectations. According to Kevin Levitt, head of NVIDIA Financial Services, financial service providers must improve the level of personalization, data security, customer service, pricing, and other aspects of the creation and delivery of financial products or risk losing market share to competitors that do.

He informs RBI: When we talked to executives at the world's largest banks, we learned that the focus in 2021 would be on moving AI and ML, as well as applications of AI in financial services, from research and innovation labs into production. In terms of production, AI has taken over.

Companies in the financial services industry now have the tools they need to increase revenue, improve customer service, and increase operational efficiencies through the use of artificial intelligence, machine learning, and deep learning.

To know about the assumptions considered for the study,Request for Free Sample Report

AI-enabled applications have emerged as the core of the new AI-led financial services enterprise since the NVIDIA State of AI in Financial Services survey of the previous year. Banks, insurers, asset managers, and fintechs are using AI-enabled applications to not only improve their services but also outperform rivals, increase customer lifetime value, and gain market share.

Over 75% of businesses in capital markets, investment banking, retail banking, and fintech use at least one of the fundamental accelerated computing use cases—high-performance computing (HPC), machine learning, and deep learning—in all financial services sectors.

Impact of AI on Financial Services According to the NVIDIA report, investments in AI are driving critical business outcomes for 91% of financial services firms. First and foremost, according to 43% of respondents, AI is producing more accurate models. AI is enabling a wide range of meaningful use cases for financial services companies in addition to model accuracy. Conversational AI is a new addition to the industry's top three priorities, while fraud detection and algorithmic trading remain the top two.

Underwriting and acquisition, conversational AI, and anti-money laundering (AML) and know-your-customer (KYC) fraud detection all saw significant increases in the percentage of businesses investing in each use case from year to year.

Levitt states, " At least 15% of respondents' businesses use nine of the 13 NVIDIA-tracking use cases. In point of fact, many are now over 25%. However, when the survey was conducted the previous year, none of the use cases had more than 14% industry penetration.

This demonstrates the rapid adoption of AI throughout the financial services industry, necessitating bank investments in enterprise AI infrastructure and strategies.

According to Levitt, there is a disconnect between the C Suite and practitioners: According to the NVIDIA survey, 37% of the C-suite regarded their own business's AI capabilities as leading the industry. However, only 20% of developers share this viewpoint.

As a result, the C-suite is enthusiastic about the AI opportunity, which is understandable. There is an opportunity to continue investing in order to provide the developers with the tools they require, regardless of how well they are actually executing on their vision and providing their teams with a genuine enterprise AI platform that can support the development of AI applications.

Levitt continues: Sincerely, data scientists are the most highly sought-after, competitive, and valuable resource in financial services today. Retaining these talented individuals is just as important as finding and hiring them.

According to NVIDIA's report, businesses must scale up the deployment of AI-enabled applications in today's market. Leadership must invest in the enterprise AI infrastructure that enables data scientists, product managers, and IT leaders to implement leadership's AI strategy in order to construct an AI-powered bank. These financial services companies will be able to achieve higher revenues, lower operating costs, greater customer satisfaction, and an overall competitive advantage in the industry by successfully implementing an AI strategy.

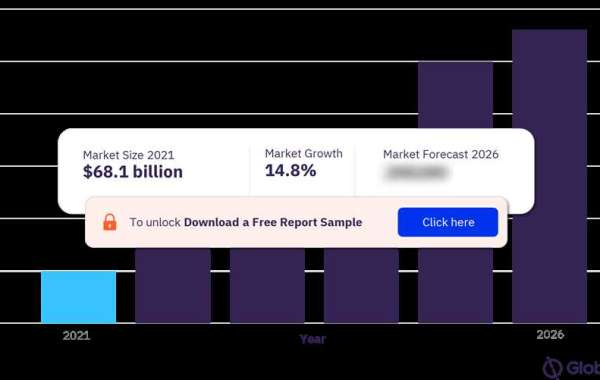

Banking with AI: According to the findings of a study conducted by GlobalData, artificial intelligence (AI) has the potential to rouse declining banks, provide them with fresh sources of income, and increase the value they derive from their existing sources by, for instance, lowering the ratio of non-performing loans (NPLs) through AI-enabled credit checks. By 2024, retail banks worldwide will spend $4.9 billion on AI platforms, according to GlobalData. This represents a 21.8% compound annual growth rate (CAGR) increase from $1.8 billion in 2019.

Indeed, the recent digitalization wave and the Covid-19 pandemic have increased the significance of AI to the banking industry. Innovative fintech firms that are cloud-native and have incorporated a suite of digital tools from the beginning are increasingly forcing banks into competition. As a result, banks have been forced to accelerate their digital transformation initiatives in order to remain competitive.

Based on data taken from GlobalData's deals, patents, and jobs databases, the graph below depicts the level of investment in AI from each sector; company filings and the CXO survey by GlobalData. Banking receives the highest score for AI adoption of any industry.