Understanding the UK Travel Insurance Market

When planning your trip to the UK, it's crucial to understand the UK travel insurance market thoroughly. To help you navigate through this intricate topic, we've outlined everything you need to know.

Types of UK Travel Insurance

- Single Trip Insurance: Ideal for one-off trips to the UK.

- Annual Multi-Trip Insurance: Suitable if you plan to visit the UK multiple times in a year.

- Family Travel Insurance: Ensures the entire family is covered during the trip.

- Business Travel Insurance: Tailored for professionals traveling to the UK for work purposes.

- Senior Travel Insurance: Designed for older travelers, considering their specific needs.

Coverage Options

UK travel insurance offers various coverage options to suit your specific requirements:

- Medical Coverage: For any health emergencies during your trip.

- Trip Cancellation: In case your plans change unexpectedly.

- Lost or Delayed Baggage: To compensate for any luggage-related inconveniences.

- Emergency Assistance: Provides support during critical situations.

- Personal Liability: Protects you in case of any legal issues during your trip.

Top Providers in the UK Travel Insurance Market

- Allianz: Known for their wide range of coverage options.

- AXA: Offers comprehensive travel insurance packages.

- Aviva: Known for their competitive pricing.

- Post Office: A popular choice for affordable insurance.

- Direct Line: Known for their quick and efficient customer service.

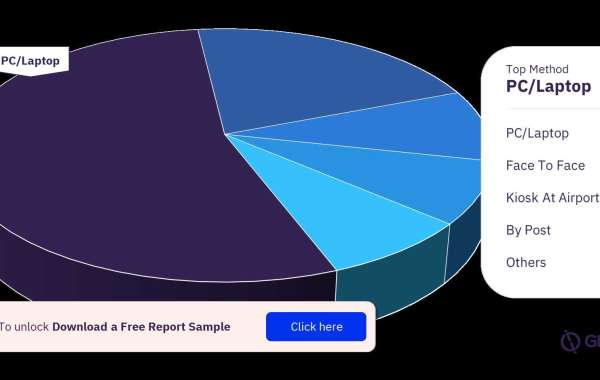

For more channel insights into the UK travel insurance market, download a free report sample